Table Of Content

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. For more on the types of mortgage loans, see How to Choose the Best Mortgage. When it does happen, it's generally because fewer people can afford to purchase homes, and the low demand forces sellers to lower their prices. A HELOC is a line of credit that lets you borrow against the equity in your home. It works similarly to a credit card in that you borrow what you need rather than getting the full amount you're borrowing in a lump sum.

Mortgage options and terminology

The loan does not require any down payment, and unlike other loans, it also does not require private mortgage insurance. While it's true that a bigger down payment can make you a more attractive buyer and borrower, you might be able to get into a new home with a lot less than the typical 20 percent down. Some programs make mortgages available with as little as 3 percent or 3.5 percent down, and some VA loans are even available with no money down at all. Let’s say you earn $100,000 each year, which is $8,333 per month. By using the 28 percent rule, your mortgage payments should add up to no more than 28 percent of $8,333, or $2,333 per month.

Custom Debt-to-Income Ratios

Home maintenance will cost money, and the larger and older the home, the more upkeep you’ll have to budget for. In a shared building, the HOA might take care of most maintenance. Some homes are in a special flood hazard area; this means you’ll probably be required to buy flood insurance.

Homebuyers Must Earn $115000 to Afford the Typical U.S. Home. That's About $40000 More Than the Typical ... - Redfin News

Homebuyers Must Earn $115000 to Afford the Typical U.S. Home. That's About $40000 More Than the Typical ....

Posted: Tue, 17 Oct 2023 07:00:00 GMT [source]

Faster, easier mortgage lending

Down Payment on a House: How Much Do You Really Need? - NerdWallet

Down Payment on a House: How Much Do You Really Need?.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]

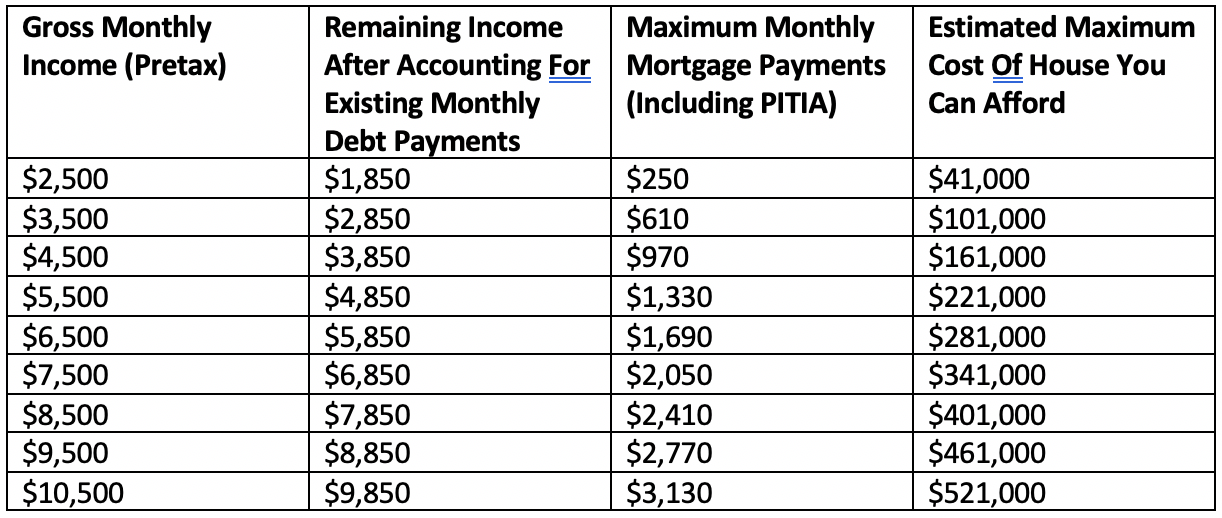

These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI). You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Loans backed by the FHA can also have more relaxed qualifying standards — something to consider if you have a lower credit score.

What is a good income to buy a house?

We offer a variety of mortgages for buying a new home or refinancing your existing one. Our Learning Center provides easy-to-use mortgage calculators, educational articles and more. Our ultimate guide for first-time homebuyers gives an overview of the process from start to finish.

You can select multiple durations at the same time to compare current rates and monthly payment amounts. If you are taking out a conventional loan and you put down less than 20%, private mortgage insurance will take up part of your monthly budget. The PMI’s cost will vary based on your lender, how much money you end up putting down, as well as your credit score.

Rates

Just because a lender offers you a preapproval for a large amount of money, that doesn’t mean you should spend that much for your home. The front-end debt ratio is also known as the mortgage-to-income ratio and is computed by dividing total monthly housing costs by monthly gross income. If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month.

The mortgage payments assume a 20% down payment, and they include property taxes and home insurance. If you carry a lot of debt, lenders may require a higher credit score or extra mortgage reserves to cover a few month’s worth of mortgage payments. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan.

But remember not to borrow more than what your budget can comfortably handle. Mortgage rates haven't changed much over the last week, but they could move up or down later this week depending on how a couple of big economic reports turn out. Currently, 30-year mortgage rates remain near 7%, according to Zillow data.

Plugging all of these relevant numbers into a home affordability calculator (like the one above) can help you determine the answer to how much home you can reasonably afford. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

No comments:

Post a Comment